Get your free

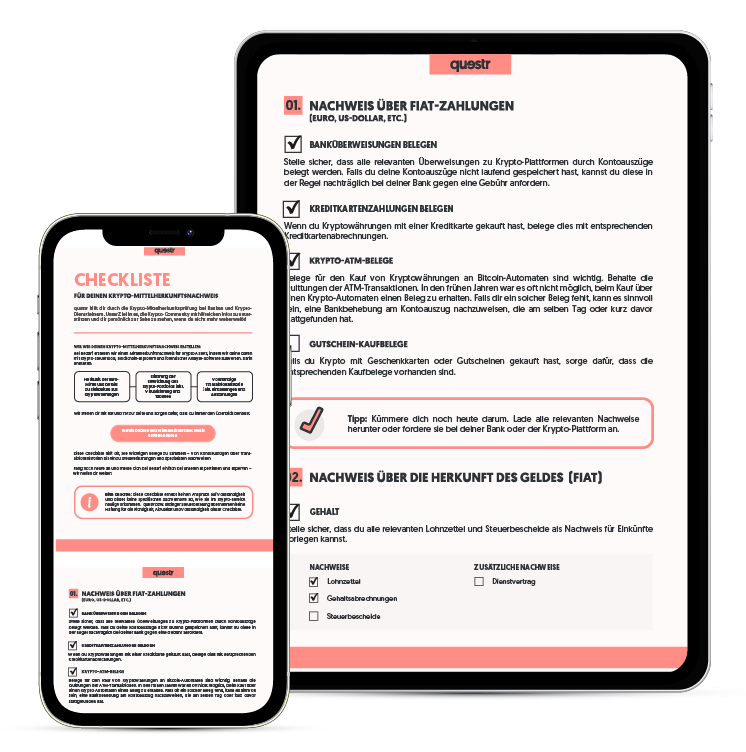

Crypto Proof of Funds checklist now. (German only)

By subscribing to the cryptotax newsletter, you will always receive the latest version of our free Crypto Proof of Funds checklist. In addition, you will receive current tips and updates on the correct taxation and cashing out of cryptocurrencies in Austria — including the free e-book Crypto Tax Guide Austria — delivered directly to your inbox.

Subscribe to the cryptotax Newsletter (German only)!

Simply subscribe to our newsletter and we will send you access to the latest free Crypto Proof of Funds checklist directly to your inbox.

Your Benefits

- Collecting the correct documentation for fiat and crypto assets

- How to substantiate the origin of your assets

- Whether tax records are required

- Potential additional supporting documentation

- Explanation of specialist and expert reports

- Simply download and tick off each item directly

Our newsletter subscribers receive not only our quarterly newsletter with the most important updates and practical insights, but also the current edition of the Crypto Tax Guide Austria.

cryptotax is the joint platform of enzinger and questr. Through our newsletter, we provide the crypto community with free and valuable downloads, insights, and practical guidance.

Have you already discovered the Crypto Tax Guide for Austria? Included with our newsletter.

Our experts have created this comprehensive, illustrated, and easy-to-understand Crypto Tax Guide to answer the most important questions regarding the correct taxation of cryptocurrencies and NFTs in Austria.

The guide includes clear explanations and practical examples of the applicable tax rates, insights into lesser-known risk areas, step-by-step instructions—with visuals—on how to correctly report crypto income in your tax return, as well as numerous best-practice tips for proper documentation of your crypto assets.

In addition, the guide addresses frequently asked questions on voluntary self-disclosures, financial penalties, and Proof of Funds requirements.

Details of the Crypto Tax Guide

Part I: Crypto Taxation in Austria

This section provides a concise overview of the fundamentals. It also includes practical overview tables covering the most common types of crypto income, the tax treatment of Bitpanda investments, as well as dedicated sections on cryptocurrencies in business contexts and commercial crypto income.

Part II: Tax Evasion, Penalties & Voluntary Self-Disclosure

We place particular emphasis on this section, as tax authorities will automatically become aware of your crypto activities under the new DAC8 and CARF regulations.

Tax evasion is a sensitive yet critical topic: we explain the associated risks, how you can protect yourself, and which options are available should issues arise.

Part III: Crypto Tax Tools – Calculating Gains Correctly

We explain why calculating crypto taxes is often complex, highlight common pitfalls when using tax tools such as Blockpit or CoinTracking, and show how to achieve accurate results despite these challenges.

Part IV: Reporting Crypto Income in Your Tax Return

Step by step, we show you how to report your crypto income in your tax return—clearly explained and practice-oriented.

Part V: Cashing Out Cryptocurrencies & Proof of Funds

Banks, exchanges, and platforms increasingly request verification of the origin of your crypto assets. We provide guidance on how to prepare effectively and how to respond promptly when such documentation is required.

Part VI: Crypto Tax FAQs

To conclude, we address the most frequently asked questions we receive regarding crypto taxation in Austria — concise and to the point.

If you encounter any issues during the newsletter registration process, please feel free to contact us by email.

We wish you every success with your Crypto Proof of Funds checklist and your Crypto Tax Guide.

Natalie Enzinger, Sigrid Wahl, Gabriel Marchesan, Elias Laner, and Benedict Stefan — your team at cryptotax & questr

If you prefer not to subscribe to the newsletter, you can access the free download here: